You could file a joint income tax come back that have a government otherwise executor acting on account of your own dead taxpayer. You are not authorizing the brand new designee for one reimburse view, bind you to definitely something (along with any extra tax accountability), or else represent you through to the FTB. If you would like build or alter the designee’s authorization, see ftb.ca.gov/poa. For their refund in person transferred into the checking account, fill in the newest account information online 116 and you can line 117. Comprehend the example at the end of that it line education. Find “Very important Times” to learn more about estimated taxation repayments and ways to stop the new underpayment penalty.

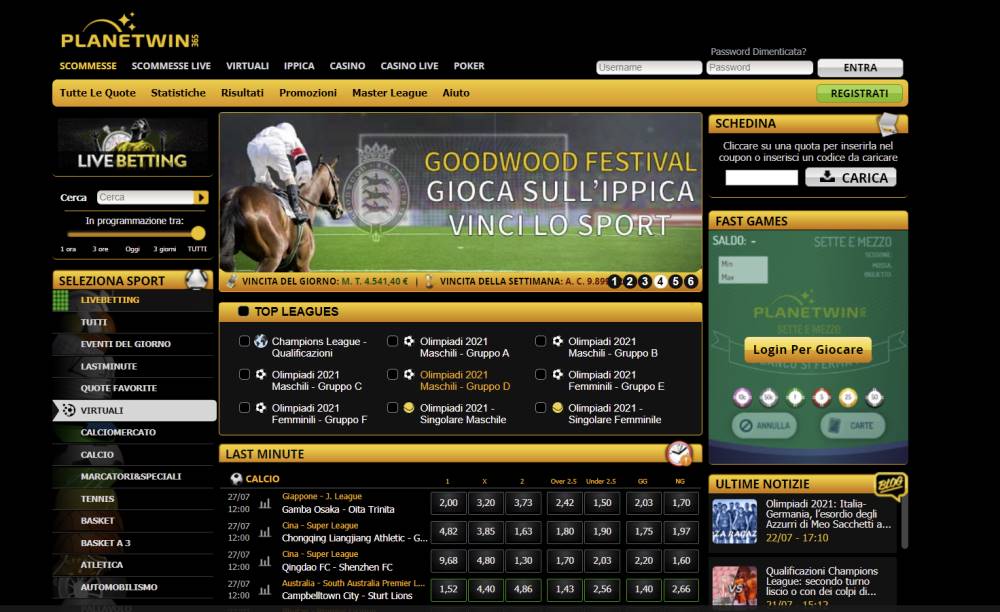

All spins win – Assembling Your Taxation Come back

Alive agent online game are often restricted, so you cannot enjoy him or her using bonus money. Betting requirements specify simply how much you ought to wager to be able to withdraw their extra winnings. They usually are given since the a multiple of the incentive (elizabeth.grams., 40x extra). Should you get a $ten no deposit bonus having wagering criteria away from 40x bonus, it means you ought to wager $400 to be able to withdraw their bonus financing and payouts. Simultaneously, other legislation and you may restrictions are positioned. As an example, there is have a tendency to a preliminary conclusion period, you have to explore the advantage and fulfill the brand new wagering standards pretty quickly.

You are leaving ftb.california.gov

- Complete the fresh done revised Function 540NR and Schedule X as well as all of the needed dates and you may support variations.

- You could carryover the excess borrowing to help you coming many years before the borrowing can be used.

- Should your Exemption merely explained doesn’t implement, comprehend the Instructions to have Mode 2210 for other things in which you happen to be able to decrease your punishment because of the processing Form 2210.

You will be charged desire for the income tax not repaid because of the April 15, 2025. If you do not afford the income tax by prolonged owed date, penalties and you can interest was imposed up until fees try paid in full. For the most upwards-to-date information regarding Setting 1127, visit Internal revenue service.gov all spins win /Form1127. Don’t request in initial deposit of your reimburse so you can a merchant account one to actually on the label, such as your taxation return preparer’s membership. While you might are obligated to pay their taxation go back preparer a fee for planning your get back, don’t have any element of the refund transferred on the preparer’s membership to pay the price tag.

- Instead, they could submit an application for a reimbursement of one’s withheld numbers.

- Information about the reimburse will normally be available in 24 hours or less pursuing the Internal revenue service get your age-recorded go back or four weeks once you post a newspaper return.

- An initial phone call to a keen FDNY Correspondence Dispatch Office try removed from the Security Acknowledgment Dispatcher (ARD), just who talks for the caller to determine the nature of your own emergency.

- If you curently have a keen ITIN, enter into they regardless of where their SSN is requested in your tax go back.

You’ll have the possibility add your own form(s) on the web otherwise obtain a duplicate to possess emailing. You’ll need scans of the data files to help with your distribution. Check out Irs.gov/Forms to view, obtain, or print the variations, tips, and you will publications you want. If you are an only manager, a collaboration, or an enthusiastic S firm, you can observe your tax information about listing on the Internal revenue service and you may perform far more that have a corporate tax account.

If you had foreign monetary possessions inside the 2024, you may need to file Mode 8938. For many who submit an application for a keen ITIN to the or before the owed go out of the 2024 come back (in addition to extensions) and the Irs items your a keen ITIN right down to the application, the fresh Internal revenue service often consider your ITIN since the provided for the otherwise ahead of the fresh deadline of your come back. If you have a centered who was put along with you to have court adoption and also you don’t be aware of the dependent’s SSN, you need to get an ATIN to the dependent in the Irs. If the dependent actually a You.S. resident otherwise citizen alien, sign up for an ITIN as an alternative having fun with Setting W-7. You need to address “Yes” otherwise “No” because of the checking the right package. A child is considered to own existed with you for all away from 2024 if the man was created otherwise died inside the 2024 as well as your house is the new child’s home for the whole go out the little one is actually alive.

Matter Refunded to you

The highest price private financial people can get are dos.00% p.a good. With the very least put element $20,000—a little for the highest top versus other financial institutions. Already, so it speed pertains to dos of the step 3 available tenors—step 3 otherwise half a year. To possess a location away from $500 to own a period of ninety days—believe it or not very easy to manage, with regards to the lowest deposit matter and you will put months. Do note that you will want to get this to put via cellular banking to enjoy it rate. A fixed deposit (also known as a time deposit) membership is a kind of bank account you to definitely will pay customers a fixed quantity of need for exchange to have depositing a specific sum of money to own a certain time period.

Police, firefighters and teachers to receive high Personal Security repayments

Box cuatro will show the degree of one advantages your paid inside 2024. If you received railway pensions handled while the public defense, you need to discover a type RRB-1099. You need to start getting at the least at least amount from the old-fashioned IRA by April hands down the seasons following the year you can decades 73. For individuals who wear’t have the lowest shipment count, you may need to pay an extra tax to the amount which will had been marketed. For facts, along with simple tips to contour minimal expected distribution, see Bar.

If you are in addition to NCNR income tax, generate “LLC” for the dotted range left of the matter to the line 82, and attach Schedule K-1 (568) with many the brand new NCNR tax said. The fresh LLC’s get back have to be recorded before one associate’s membership might be paid. To figure and allege very unique credit, you ought to complete a different form or agenda and you will mount they on the Function 540NR. The credit Graph describes the newest credits and will be offering the name, borrowing from the bank password, and quantity of the mandatory setting or agenda. For those who document Function 540NR, have fun with Plan Ca (540NR), line An off line D in order to compute your own complete modified terrible earnings as if you have been a citizen out of California for the whole seasons. Have fun with line E to help you calculate all the items of full modified disgusting money you acquired when you’re a resident away from Ca and those your acquired away from California provide when you are an excellent nonresident.

You’ll understand the RTP since the 96.18% otherwise a figure such as 94.33% once discovering that phrase. Other RTP thinking may appear because the game boasts a great a good extra come across element, because seem to provides another RTP, but not, will be nearly as the tool high quality RTP used by the fresh online game. If your local casino spends the great RTP mode, it would be on the 96.18%, and if the new gambling enterprise spends the newest crappy RTP version, the newest RTP are as much as 94.33%. Provides incentives inform you promoting also offers in which gambling company suits the company the newest the fresh player’s very first lay with the same amount of commission on the finest.